Industries across the globe are experiencing labor shortages in many areas, but the positions most urgently needed – and most difficult to fill – are in information technology (IT). Here in the U.S., there are nearly 4 million unfilled IT positions,1 600,000 of them for cybersecurity positions,2 and the computer/IT job sector is expected to grow by an additional 13% by 2030.3

The IT talent shortage has been anticipated for some time and was accelerated by the pandemic, which caused both an expansion of IT projects, including digitization, automation, and cybersecurity initiatives, and a reshuffling of the labor force. For example, over 69% of organizations have expanded their cloud workloads over the past year,4 while a survey in late 2021 reported that 72% of tech employees were considering leaving their jobs in the year ahead.5

The attrition rate for IT employees in the U.S. has always been high, averaging 13.2% in 2018, but after 2020 the turnover rate increased to 21.3 %6 for technology workers with no signs of reversal anytime soon. The employee turnover rate across all job sectors increased by an average of 25% in 2021.7

The acute shortage of qualified IT workers is due to a number of factors, none of which are easily addressed, including:

The impact of the IT talent shortage on U.S. businesses is great and, according to one study, could cost the U.S. economy more than $160 billion in revenue by 2030.8 Already, IT executives cite a shortage of talent as the primary obstacle to 64% of new technologies they would like to adopt, 75% of which are automation technologies.9

As serious as the IT talent shortage is for U.S. industries in general, it is particularly concerning for the insurance sector.

The general labor shortage is greater in the insurance industry where the unemployment rate is only 1.5%, as compared to 3.6% for all industries.10 This is because insurance carriers were dealing with a talent shortage well before the pandemic, largely due to an aging workforce and a scarcity of younger workers attracted to a career in insurance. The median worker age in the insurance industry is 45, as compared to 42 for all industries, and 25% of the current insurance labor force is 55 years of age or older.10 Replacing those older workers is a challenge because, when surveyed, fewer than one in 10 millennials expressed interest in working in the insurance industry and eight out of 10 millennials said they were not even familiar with the industry.11

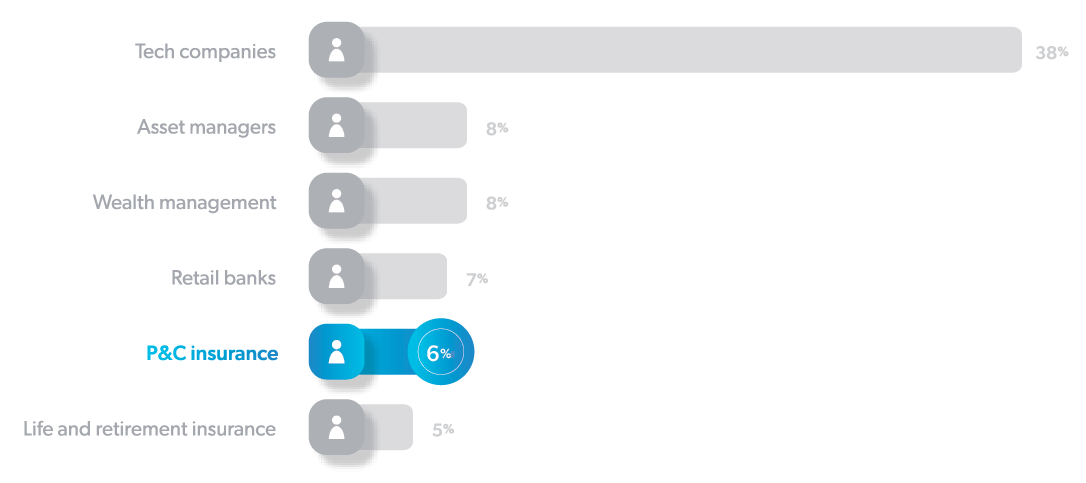

Workers are in short supply for a variety of positions in insurance, including claims adjusters, underwriters, and risk managers.12 Ironically, for many insurance company executives, technology is a primary piece of their strategy to maximize the talent they have and the tech talent they need to execute those strategies is in exceedingly short supply. In fact, insurers have the smallest pools of IT talent when compared to other financial services organizations. 13

% of full-time equivalents (FTEs) in digital roles1

Insurance IT leaders are struggling to fill vacant positions, reporting that 65% of IT projects are delayed due to staffing shortages. In addition, 64% report that the IT staff they do have are experiencing burnout.14

Nevertheless, insurance companies are accelerating investment in technology initiatives, primarily focusing on these areas:

The level of investment and resources required for technology initiatives depends not only on the scope of the project, but also on the agility of the underlying legacy system. As noted in a recent McKinsey report on this topic, “putting a workflow engine on top of a legacy system usually does not work long-term.”15

Legacy systems are a concern for the industry overall, and for the workers’ comp sector in particular.

In a recent Healthesystems’ survey, 30% of participants cited outdated/legacy infrastructure as a factor likely to impact business resiliency and 40% of claims professionals saw outdated or inadequate claims processing systems as an obstacle to facilitating medical care for injured workers.16

The traditional, somewhat rigid, claims process can be frustrating to various stakeholders in workers’ comp and claims process automation was cited as the #1 most important technology 16 for workers’ comp stakeholders in the next three to five years.

And there is good reason to agree that automation should be a priority. When done well, automating processes can reduce manual effort, increase efficiency, reduce costs, and give experienced professionals more time to give more focused attention where it is needed, thereby improving the injured worker patient experience, as well as their own.

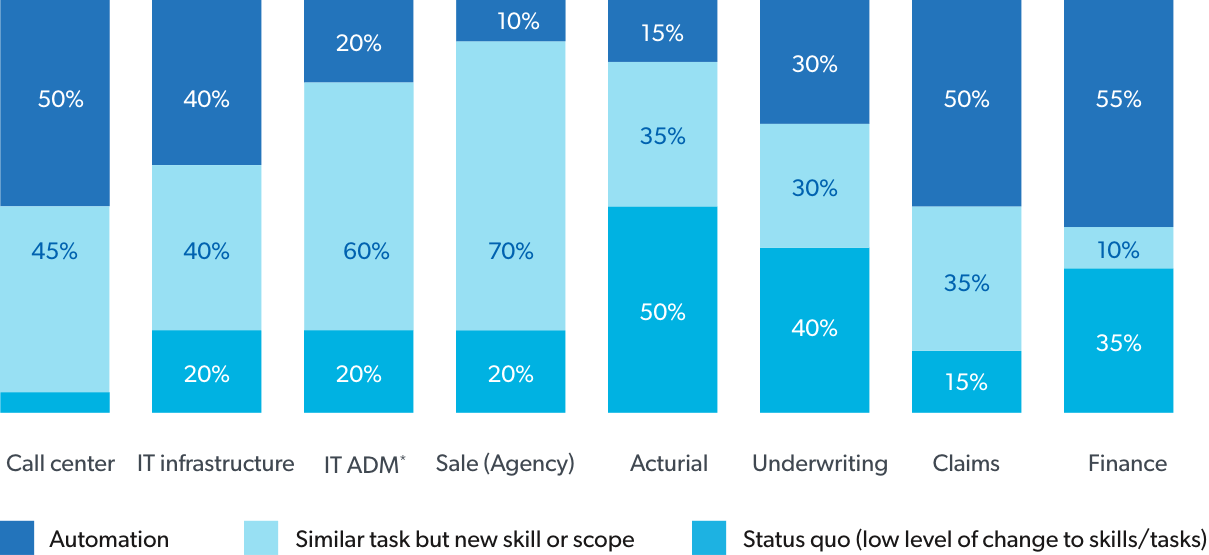

In fact, increased automation is likely to change the job descriptions for many insurance industry professionals, including within workers’ compensation.

*Application Development and Maintenance

When so many manual tasks are automated, valued employees will have more time to use skills that require a human touch. Bringing more automation to the industry will likely change the skills required for many positions and may make them more desirable to younger workers.

Cybersecurity has become a top priority for organizations as the need grows to digitize and push information to more endpoint devices for employees, partners, and customers. Additionally, the increase of remote workers and adoption of cloud-based technologies have created a borderless network environment which adds an even greater level of risk to both organizational data and computer systems.

In just one year, from 2020-2021, the percentage of technologies in deployment for security purposes rose from 15% to 84%, and IT leaders who are planning to increase security technology investments rose from 31% to 64% during the same period.9

Available talent to execute on those investments is in short supply. Between 2013 and 2021 the number of unfilled cybersecurity jobs worldwide increased 350% from 1 million to 3.5 million.17 In the U.S., over 700,000 cybersecurity jobs remain unfilled.18 Though there has been a tremendous effort to remedy this trend, the everchanging landscape in both technology and risk makes this an arduous task to overcome. This is a particularly serious challenge in workers’ compensation where all claims involve injury or illness and, therefore, personal health information (PHI) and other identifying information, such as social security numbers.

“Hackers are extremely attracted to this type of confidential data and the organizations that maintain it, due to the large quantities they store and the estimated value of $180 for each compromised record. Workers’ comp is a highly valuable target for identity theft, phishing attacks, ransomware, and other security threats,” explained Tony Brown, Director, Information Security at Healthesystems.

So, the need for automation, technological growth, and an improved user experience must be balanced with the appropriate level of security training, education, and awareness for all employees emphasizing the absolute requirement to keep data private and secure.

Workers’ comp is a highly valuable target for identity theft, phishing attacks, ransomware, and other security threats.”

Tony Brown, Director, Information Security

Healthesystems

The competition for IT talent is fierce and spans myriad industries and geographies. Some things to consider in filling IT jobs and keeping important technology projects moving forward are:

The workers’ comp mission is to restore injured workers to good health and get them back to work as quickly as possible. Digitization, automation, data analytics, and cybersecurity are increasingly important to accomplishing this mission. The following tips can help workers’ comp payers optimize the resources they have and prioritize technology projects to accomplish essential goals: